Economy

Economy

24 Jan, 2026

Barter Trade Resurges in Russia Amid Western Sanctions and Economic Strains

Macario Yambao

Russia has witnessed a revival of barter trade in its foreign commerce for the first time since the early 1990s, as businesses seek to navigate and circumvent Western sanctions imposed over the conflict in Ukraine and the Crimea annexation.

Major sanctions from the U.S., Europe, and allied nations — totaling over 25,000 measures — aim to cripple Russia's $2.2 trillion economy and pressure the Kremlin. Despite this, Russian President Vladimir Putin has declared the economy to be more resilient than expected, noting growth exceeding that of G7 countries in recent years.

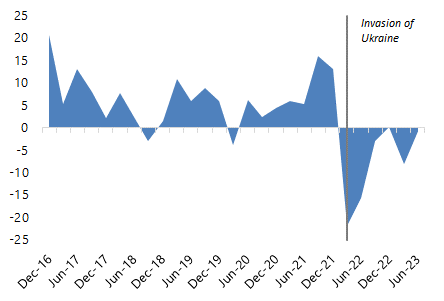

Nevertheless, the Russian economy faces mounting difficulties, including a technical recession and high inflation rates. The sanctions have disrupted access to global financial systems, with Russia's banks disconnected from the SWIFT payment network and Chinese banks wary of secondary sanctions.

Under these constraints, barter transactions have begun to re-emerge as a less traceable means of conducting trade. The Russian Economy Ministry issued a detailed 14-page "Guide to Foreign Barter Transactions" in 2024, outlining how companies can leverage barter exchanges to circumvent sanctions. It also proposed establishing a trading platform dedicated to barter transactions.

Trade sources and customs data indicate growing instances of direct goods-for-goods exchanges between Russia and countries like China and Pakistan. One notable deal involved trading Russian wheat for Chinese vehicles, where the Chinese side requested payment in grain rather than currency. Additional transactions included the exchange of flax seeds for Chinese household appliances and building materials, and metals traded for machinery and raw materials.

Maxim Spassky, Secretary of the General Council of the Russian-Asian Union of Industrialists and Entrepreneurs, remarked, "The growth of barter is a symptom of de-dollarisation, sanctions pressure and liquidity problems among partners," predicting that barter volumes will continue to increase.

Evidence of barter's rising significance is reflected in the widening gap—estimated at $7 billion in the first half of 2024—between Russia's central bank trade statistics and customs service records.

Russia's customs officials acknowledge that barter occurs across various goods and trading partners, though they describe such transactions as minor compared to overall foreign trade volumes. From January to July 2024, Russia’s foreign trade surplus fell 14% year-on-year to $77.2 billion, with exports dropping $11.5 billion and imports rising slightly.

Several industry insiders also report that barter enables the import of Western products into Russia despite sanctions, though details remain undisclosed. Moreover, alternative payment strategies, including the use of payment agents, the state-controlled VTB Bank’s Shanghai branch, and cryptocurrencies pegged to the U.S. dollar, are being utilized by businesses to maintain trade flows.

At the August Kazan Expo business forum, Xu Xinjing, chairman of China's Hainan Longpan Oilfield Technology Co., emphasized barter's potential, stating, "In the current conditions of limited payments, barter provides new opportunities for enterprises in Russia and Asian countries."

Historically, barter dominated Russia's post-Soviet economy in the 1990s amid cash shortages and rampant inflation, resulting in complex and often opaque transaction chains that hampered valuation and fostered economic instability. Today, barter's resurgence is a direct consequence of geopolitical pressures and the evolving international trade landscape, underscoring the enduring impact of sanctions on Russian commerce.

"There is no ready-made technological answer yet. The economy is surviving, and business is simultaneously applying 10-15 different payment methods," said Sergey Putyatinsky, Vice President for Operations and IT at Russian financial firm BCS, highlighting the adaptability of Russian enterprises amid current challenges.

Recommended For You

GSIS Emphasizes Member Feedback to Drive Reforms at 2025 NCR Stakeholders’ Dialogue

Jan 24, 2026

Felicidad Dimaculangan

Leptospirosis Cases Surge to 106 in Cebu Amidst Typhoon Aftermath

Jan 24, 2026

Nemesio Gatdula

Authorities Seize ₱133 Million Worth of Suspected Cocaine in Palawan Coastal Area

Jan 24, 2026

Macario Yambao

DPWH and ICI Recommend Plunder Charges Against Leyte Rep. Romualdez and Former Ako Bicol Rep. Co

Jan 24, 2026

Basilia Magsaysay