Economy

Economy

05 Nov, 2025

Fed Governor Miran Warns Current Monetary Policy Is Excessively Restrictive Amid Changing Economic Conditions

Nemesio Gatdula

Federal Reserve Governor Stephen Miran emphasized that ongoing shifts in U.S. immigration, tax, and regulatory policies are contributing to a lowering of the underlying neutral interest rate, thereby rendering current monetary policy excessively restrictive for maintaining the Federal Reserve's 2% inflation target.

In remarks prepared for the Economic Club of New York, Miran stated, "The upshot is that monetary policy is well into restrictive territory. Leaving short-term interest rates roughly two percentage points too tight risks unnecessary layoffs and higher unemployment."

Miran recently dissented during the Fed's decision to cut the benchmark interest rate by 0.25 percentage points, arguing that a 0.5 percentage point reduction was more appropriate. Furthermore, he projected half-point cuts at the next two Federal Open Market Committee meetings, acknowledging that his stance differs significantly from that of other Fed members.

While serving on leave as chair of President Donald Trump’s Council of Economic Advisers, Miran's calls for more aggressive rate cuts raised speculation about political influence. However, he contended that these recommendations stemmed from economic analysis rather than political motivations.

Central to Miran's argument is that the Fed's peer group has underestimated the impact of the Trump administration's policies—especially tariffs, tightened immigration, and deregulation—on reducing the "neutral" rate of interest. This neutral rate, while unobservable and difficult to estimate, is the theoretical level at which monetary policy neither stimulates nor restrains economic activity excessively.

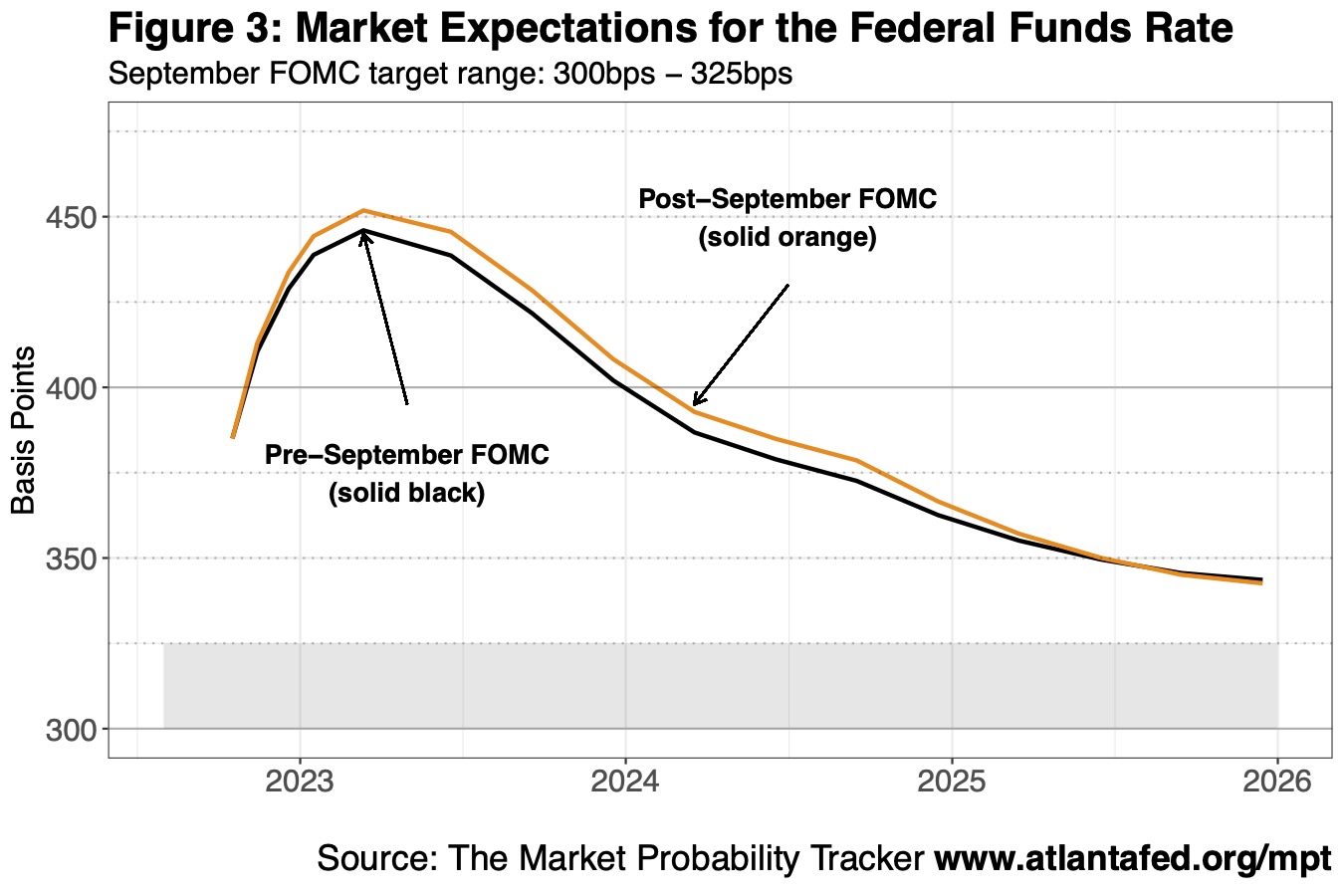

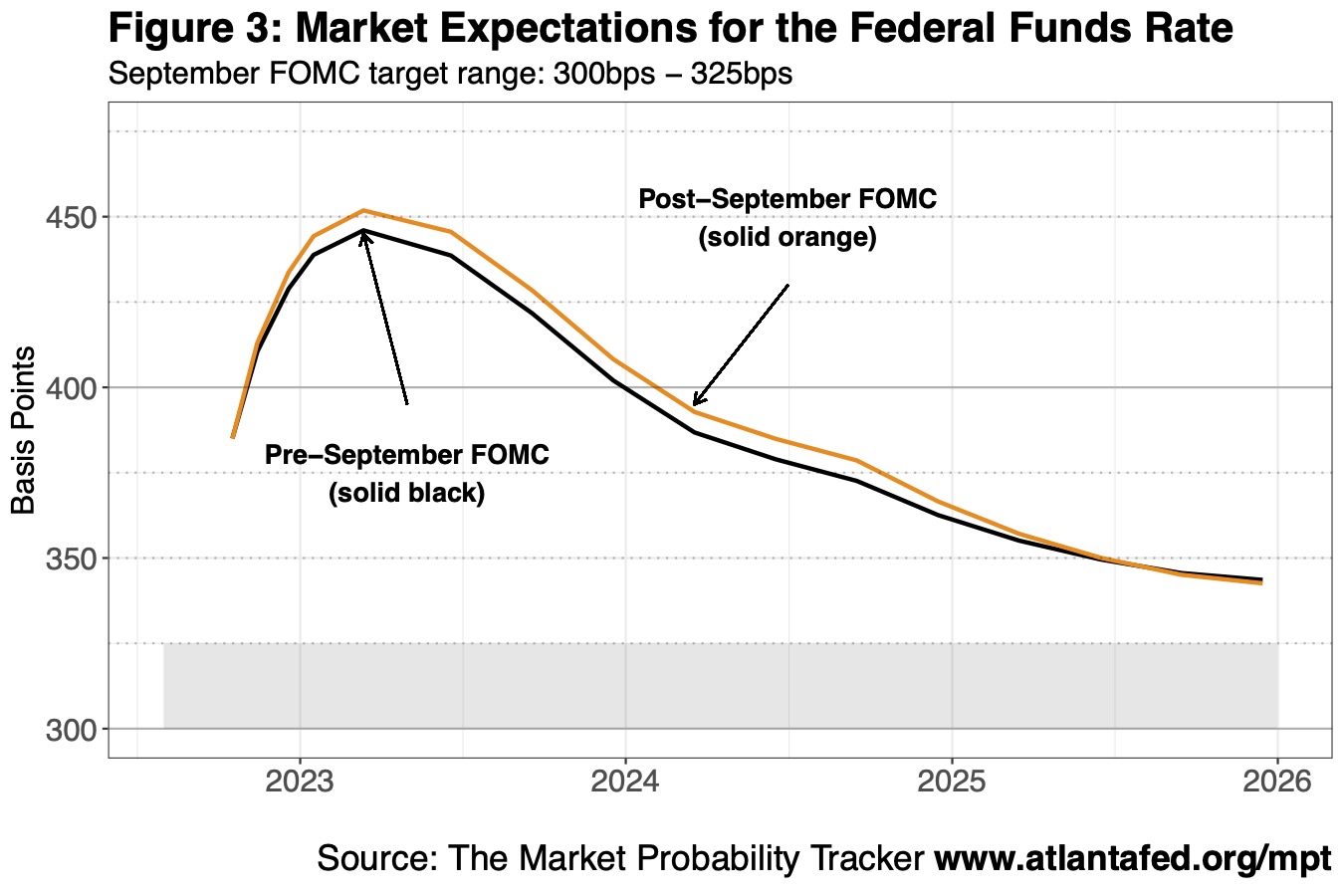

According to Miran, the current federal funds rate range of 4% to 4.25% is too restrictive given the lowered neutral rate, which he believes now warrants a policy rate closer to 2.75% to 3% by year-end. He explained, "Insufficiently accounting for the strong downward pressure on the neutral rate resulting from changes in border and fiscal policies is leading some to believe policy is less restrictive than it actually is."

Conversely, other Federal Reserve officials worry the neutral rate might be higher than estimated, implying that monetary policy is less tight and that aggressive rate cuts could spur inflation. Miran, however, pointed out that several administration policies have also contributed to restraining inflation; specifically, he cited immigration restrictions easing pressure on the housing market, noting, "I believe forecasters have underappreciated the significant impact of immigration policy on rent inflation."

Regarding trade tariffs, he suggested the market's inflation concerns are somewhat overstated, describing them as "unreasonable levels of concern."

Inflation currently remains about one percentage point above the Fed's target, prompting Fed officials last week to anticipate two additional quarter-point rate cuts this year. Yet, Miran’s projection for the policy rate is significantly lower, with expectations around 3% at the end of 2025, contrasting with a median forecast that is nearly 0.75 percentage points higher.

Miran’s insights underscore a critical debate within the Federal Reserve about the appropriate level of interest rates amid evolving economic and policy landscapes.

Recommended For You

Several Charities Sever Ties with Duchess of York Over Epstein Email Revelations

Nov 05, 2025

Macario Yambao

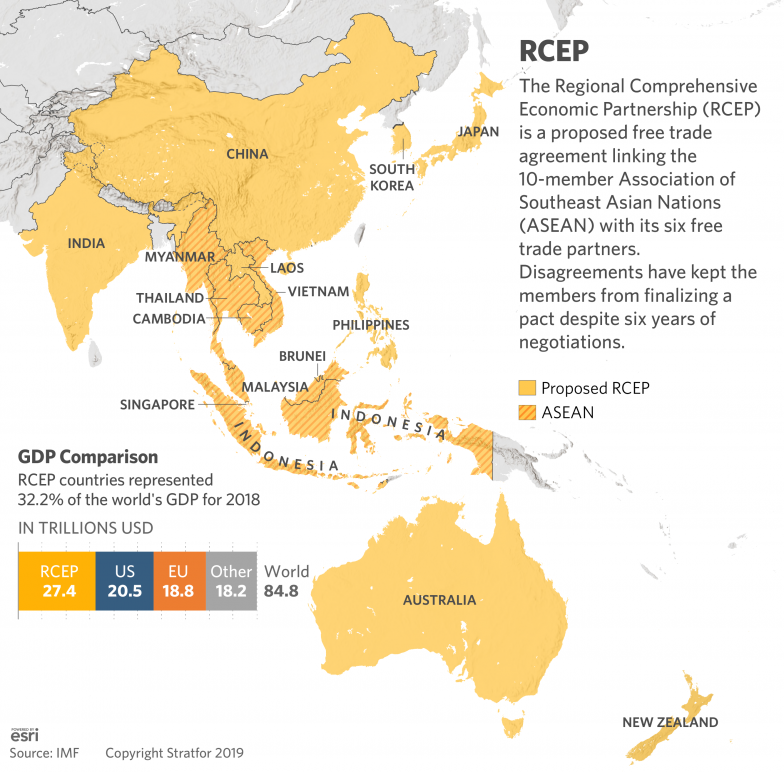

RCEP Leaders to Discuss Expansion and Trade Enhancement at Upcoming ASEAN Summit

Nov 05, 2025

Nemesio Gatdula

Fed Governor Miran Warns Current Monetary Policy Is Excessively Restrictive Amid Changing Economic Conditions

Nov 05, 2025

Nemesio Gatdula

Philippine Navy Boosts Security in Eastern Mindanao with Arrival of Three New Vessels

Nov 05, 2025

Nemesio Gatdula