Economy

Economy

24 Jan, 2026

Rising European Medical Costs Prompt Filipino Travellers in UAE to Prioritize Travel Insurance

Macario Yambao

Medical expenses in Europe have increased by approximately 21% over the past four years, posing significant financial risks to travellers, especially Filipino nationals residing in or travelling from the UAE. Unexpected hospital bills in popular European destinations can escalate quickly, with emergency medical transportation alone costing between US $25,000 and $50,000 in some instances.

Experts advise that standard health insurance often does not cover illnesses or accidents that occur outside a traveller's home country. Therefore, Filipino travellers heading to Europe must ensure their travel insurance explicitly covers overseas medical costs. Without appropriate coverage, even a short hospital stay abroad could become prohibitively expensive.

"Planning ahead by verifying coverage limits, exclusions, repatriation provisions, and partnering hospitals can greatly reduce stress in case of medical emergencies," an industry specialist noted.

In addition to securing insurance, meticulous preparation of travel documents is essential. Filipino travellers are urged to gather necessary paperwork such as a valid passport, UAE residence visa, travel itinerary, proof of funds, Emirates ID, recent passport photos, bank statements, and insurance policy details well before departure. Selecting the correct visa category aligned with the main destination and travel purpose is critical to avoid delays.

Travel insurance costs typically range from 4% to 6% of the total trip expense, varying based on destination, age, and duration. Policies for tourism or business travel to Europe should comprehensively cover medical emergencies, evacuation, and cancellations. While younger, healthy travellers might opt for basic plans, those with pre-existing conditions or extended stays should consider higher coverage limits.

Booking insurance promptly upon confirming travel plans is vital to minimize the risk of policy adjustments or coverage gaps.

Once in Europe, travellers should remain vigilant by familiarizing themselves with local emergency contacts and hospital options within their insurer's network. Carrying both digital and physical copies of insurance and visa documents ensures quick access during emergencies. Immediate notification of insurers following an accident is crucial to enable direct management of care and costs, potentially averting inflated expenses.

Filipino travellers are encouraged to treat travel insurance as a fundamental component of their journey, ensuring peace of mind and financial protection while abroad.

Recommended For You

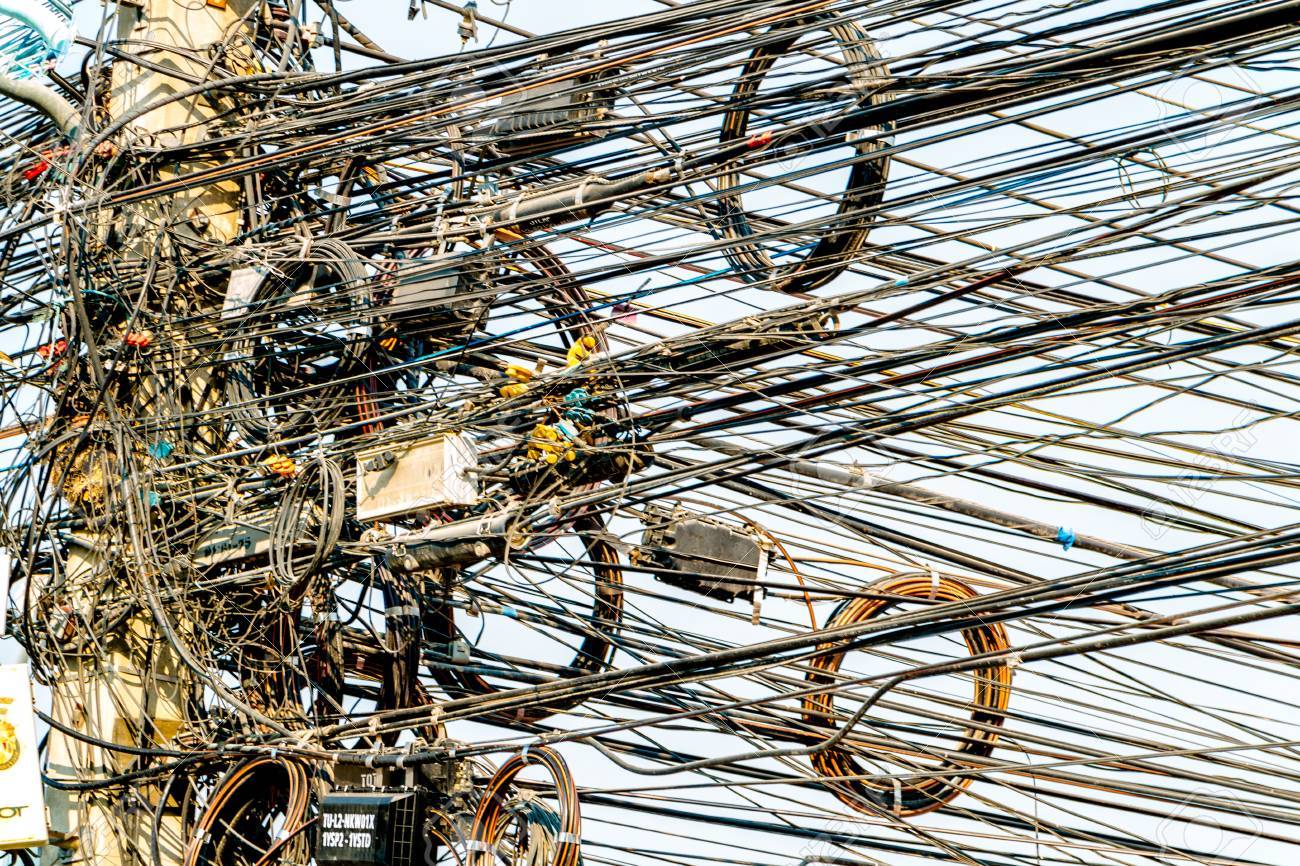

Bacolod City Council Orders Immediate Cleanup of Hazardous Cable Installations

Jan 24, 2026

Crispin Abella

Comelec Urges Bangsamoro Transition Authority to Enact Districting Law by November 2025

Jan 24, 2026

Basilia Magsaysay

GSIS Emphasizes Member Feedback to Drive Reforms at 2025 NCR Stakeholders’ Dialogue

Jan 24, 2026

Felicidad Dimaculangan

BRAVE CF 102 to Feature Pivotal Heavyweight Title Contender Bout in Slovenia

Jan 24, 2026

Basilia Magsaysay