Business

Business

05 Nov, 2025

Philippine Flood Control Scandal Highlights Urgent Need for Governance in Family Businesses

Nemesio Gatdula

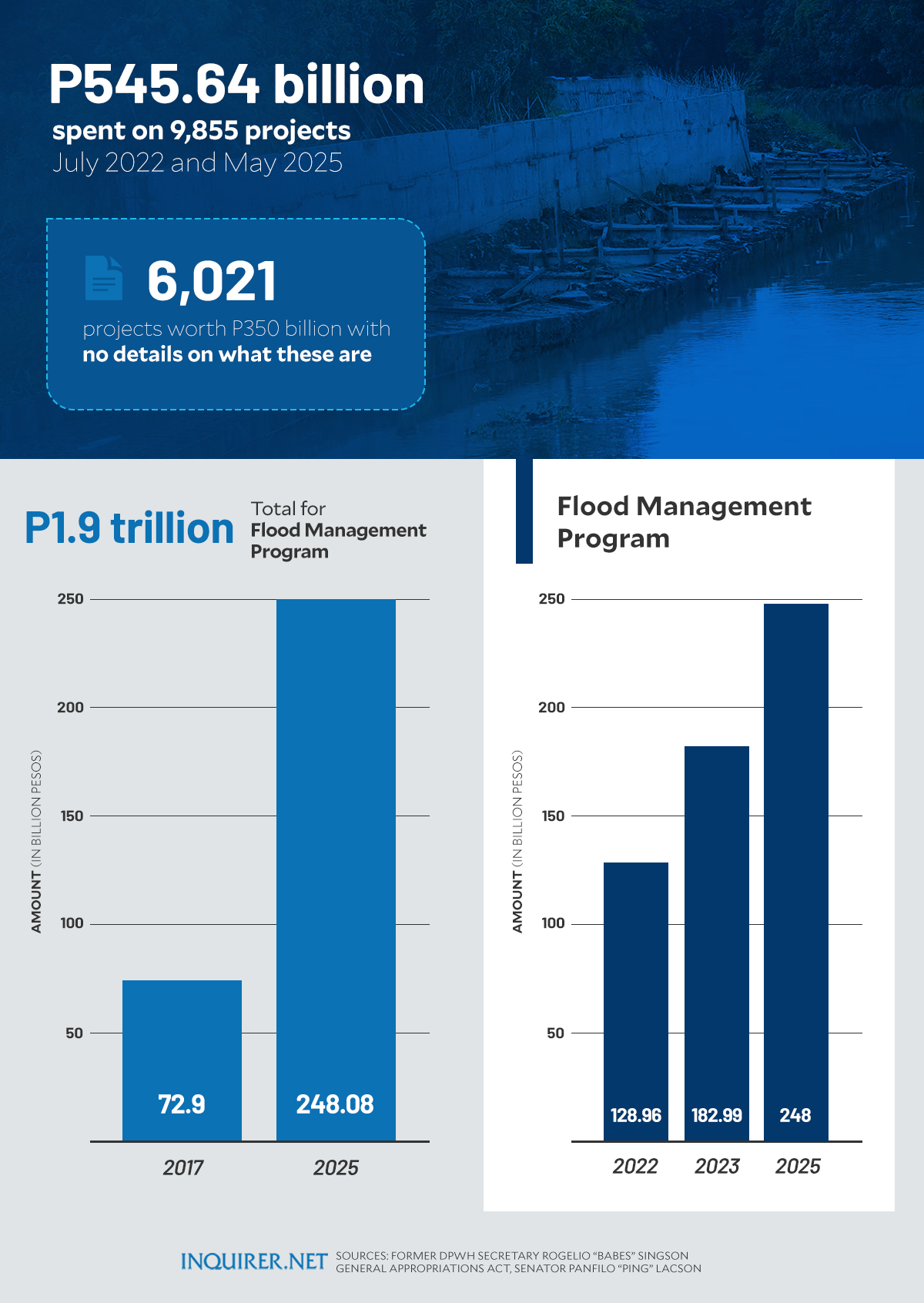

The Philippines has recently been shaken by revelations of extensive corruption within flood control initiatives, where kickbacks, inflated contracts, and even nonexistent projects diverted public funds meant to safeguard communities. At the core of this scandal lies a significant lack of accountability and oversight, demonstrating how unchecked power can foster self-interest at the expense of public welfare.

This incident serves as a stark warning for family-run businesses. Much like governments plagued by corruption, family enterprises that inherit wealth without establishing robust governance mechanisms are vulnerable to similar abuses. In both settings, the absence of transparency and accountability can allow individuals to prioritize personal gain over collective interests.

Parallels in Family Business Governance

In many family businesses, the founder wields ultimate decision-making power, with their vision often excusing unilateral actions. However, once the founder is no longer present, power vacuums may lead to self-serving behavior by successors. Without sound governance, successors might emulate authoritarian leadership without the accompanying foresight or experience.

Similar to corrupt officials demanding kickbacks in the flood control scandal, some family members may exploit their positions, awarding favorable contracts to allies, misdirecting funds, or engaging in dubious partnerships. Such environments, lacking clear rules, inevitably breed abuse, mistrust, and conflict.

Illustrative Case: The S Family Conglomerate

A notable example involves the S family, proprietors of a diverse enterprise in real estate and manufacturing. Following the passing of the family patriarch, his three children inherited shares equally. The eldest son, acting as CEO, covertly favored a construction company partly owned by him for all projects.

These contracts were routinely overpriced with unusually high profit margins. Despite steady revenues, dividends decreased over time. An external audit, initiated by a minority shareholder relative, revealed that millions had been siphoned off through these inflated agreements.

The fallout was severe: litigation erupted, family members ceased communication, and one faction divested their shares, feeling betrayed. The absence of proper oversight enabled one individual to unjustly benefit while others were kept uninformed.

The Consequences of Silence

Such scenarios are unfortunately common in many Asian family businesses, where a strong emphasis on familial loyalty deters confrontation. Relatives may privately question dubious practices but avoid raising issues to preserve the family’s reputation. This silence effectively becomes complicity. Just as the flood control scandal demonstrates how billions can be lost through passive acceptance, family enterprises risk their legacies when self-enrichment goes unchecked.

The repercussions extend beyond finances, causing fractured relationships, damaged reputations, and the erosion of shared goals. Ultimately, the family business may transform from a unifying legacy into a source of division.

Establishing Essential Governance Mechanisms

The key takeaway is that goodwill alone is insufficient. Families must implement clear structures to deter mismanagement. Recommended measures include:

-

A Family Constitution articulating shared values, vision, and engagement guidelines.

-

A Family Council providing a forum for transparent discussion and resolution of grievances.

-

A Shareholder Agreement safeguarding minority interests and outlining transaction procedures.

-

An Independent Board to ensure decisions prioritize the enterprise’s long-term sustainability.

While these frameworks cannot eliminate conflict entirely, they help manage disputes fairly and prevent any single individual from commandeering the business for personal advantage.

A Call for Reflection

The flood control corruption case reveals how easily systems collapse when leaders treat power as an entitlement to personal enrichment. Family enterprises must heed this lesson. If government institutions—with their formal controls—can succumb to corruption, family businesses without similar checks are even more at risk.

Ultimately, in the absence of accountability, family wealth dwindles, trust disintegrates, and the once proud legacy is endangered.

(The upcoming second part will explore the costs associated with conflicts of interest within family enterprises.)

Recommended For You

Kazakh President Urges Diplomatic Resolution in Meeting with Ukraine's Zelensky in New York

Nov 05, 2025

Macario Yambao

Over 61,000 Filipinos Rally Nationwide Against Corruption on Martial Law Anniversary

Nov 05, 2025

Nemesio Gatdula

17-Year-Old Detained for Alleged Misconduct Against Disabled Woman in Cebu City

Nov 05, 2025

Crispin Abella

Philippines Launches "White Revolution" to Boost Vegetable Supply and Curb Import Dependence

Nov 05, 2025

Nemesio Gatdula